About Us

- Home

- About Us

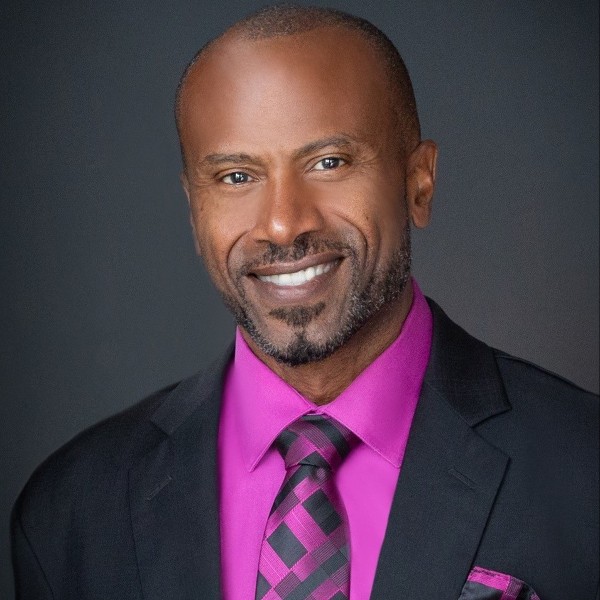

Lyndon Davis

Financial Advisor , Senior Vice President, Investments at Raymond James

Our Mission

Personalized Service

We understand that financial planning is not one-size-fits-all. Our advisors take the time to understand your goals and create tailored solutions.

Holistic Approach

We take a comprehensive view of your financial situation, considering all aspects to develop a well-rounded strategy.

Education and Empowerment

Long-Term Partnerships

Education and Empowerment

Personalized Service

Long-Term Partnerships

Holistic Approach

We take a comprehensive view of your financial situation, considering all aspects to develop a well-rounded strategy.

01

Financial Consulting

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

02

Strategic Planning

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

03

Market Research

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

04

Marketing Consulting

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Let's Build Your Financial Future Together

- Phone: +2(02) 2737 6756

- [email protected]

- Montecito, California, United States

Debt Solutions

You understand the critical impact of debt on your financial well-being. Introducing the Debt Dominoes™ system, a revolutionary approach to conquering debt strategically and efficiently.

What is the Debt Dominoes™? Imagine playing a game of dominoes with your debts. Each debt represents a tile, and when you set them up correctly, they fall one after the other, automatically.

Here’s how it works

Aggregate

Line up all your debts in a list.

Negotiate

Armed with your debt list, it’s time to negotiate for better rates/terms.

Reallocate

Arrange your debt list in an order that is most suitable or convenient for you.

Eliminate

Begin paying your debts according to your Debt Dominoes™ plan.

Celebrate

With each debt felled by your Debt Dominoes™ plan take a victory lap.

Why Choose Debt Dominoes™?

We have the best experts to elevate your business to the next level, try is and you will see!

Empowerment

Regain control of your financial life.

Simplicity

No complex strategies—just a straightforward system.

Confidence

Watch your debts fall systematically.

Remember, you’ve already experienced the worst debt had to offer. Now it’s time to enjoy the journey upward by watching your debts fall downward! Debt Dominoes™ system works—more importantly, it works for you!

Financial Planning

Don’t wait until tomorrow to take charge of your financial future. Contact us today for a free consultation and let’s get started.

Confident investing

Feeling unsure about the stock market? We'll guide you through investment strategies based on your risk tolerance and goals.

Preparedness for the unexpected

Life throws curveballs. We'll help you plan for emergencies and protect your loved ones financially.

Peace of mind

Knowing you have a plan in place can be incredibly freeing. We'll help you achieve financial security and focus on what matters most.

You can stop imagining and open your eyes now. We are here to make it happen! Our financial planning services are designed to empower you to take control of your financial future. We work with you to understand your unique needs, wants, wishes and ultimately your goals. You take on your role – to paint a picture to your heart’s content. Then it’s up to us to fulfill our fiduciary duty to make that picture become a reality.

Tax Strategies

Outsmart Your Taxes, Not Just File Them.

Tax season arrives each year, bringing with it a familiar blend of stress and missed opportunities. But what if you could leverage taxes to your advantage, turning them from a burden into a strategic tool?

This is where we come in. We go beyond basic filing to help you:

Unearth hidden deductions and credits

We're not just tax preparers; we're tax strategists. We delve deep into your finances to uncover often-missed deductions and credits tailored to your unique situation.

Optimize your investments for tax efficiency

Not all investments are created equal from a tax perspective. We help you make informed choices that minimize your tax liability while aligning with your overall financial goals.

Proactively plan for future tax implications

Tax laws are constantly evolving. We stay ahead of the curve, anticipating changes and guiding you towards strategies that minimize your tax burden for years to come.

Achieve financial peace of mind

Taxes shouldn't be a source of anxiety. We provide ongoing guidance and support, ensuring you're on the right track and prepared for any tax challenges that may arise.

Don’t just file your taxes. Outsmart them. Contact us today for a personalized consultation and discover how tax strategies can empower you to achieve your financial goals.

Risk Management

Risk management is the process of identifying, assessing, and mitigating the potential threats and losses that may arise from various sources. There are at least 10 common risks that lie in plain sight that most people do not take notice of. These risks are in areas such as investments, taxes, real estate, account titling, estate plans, insurance, and others.

When it comes to risks you have but two choices – you can either transfer the risk or retain the risk. Additionally, there are some risks that cannot be transferred and must be retained. Your health, for example, is something that you can only mitigate the risk of loss but cannot transfer. For transferrable risks, you can protect your wealth, achieve your financial goals, and secure your legacy by applying prudent risk management strategies.

We offer comprehensive risk management solutions tailored to your specific needs and objectives. Don’t let risk derail your financial success. Contact us today and let us help you manage your risk and maximize your opportunities.

Why Choose Debt Dominoes TM?

- Empowerment : Regain control of your financial life.

- Simplicity : No complex strategies—just a straightforward system.

- Confidence : Watch your debts fall systematically.